The recent Federal Reserve rate cut has sparked significant interest and discussion among economists and consumers alike. This sweeping interest rate reduction, the first in four years, promises to influence various financial sectors, from mortgage rates to credit card debt. As the Fed aims to stimulate economic growth, the impact on consumers is expected to be profound, especially for those grappling with high-interest debts. Reducing borrowing costs could provide relief to households and spur investment, while potential reductions may further ease mortgage rates, making home purchases more accessible. Understanding these developments is crucial as they mark a pivotal moment for American economic policy and personal finance.

In recent developments, the Federal Reserve has opted to lower its key borrowing costs, a move often referred to as an interest rate cut. This shift in monetary policy is geared towards fostering a more favorable economic climate, with particular emphasis on supporting consumers suffering from high credit card rates and stagnant debt relief. By adopting this approach, the Fed aims to encourage not just home buying through decreasing mortgage rates, but also to invigorate overall economic growth. Such reductions play a vital role in shaping the financial landscape, especially in how they affect consumer purchasing power and their ability to manage existing debts. Observing how these changes manifest in real-time will be essential for both individual consumers and broader financial markets.

Understanding the Federal Reserve Rate Cut

The recent decision by the Federal Reserve to implement a rate cut of half a percentage point has triggered discussions across economic landscapes. This interest rate reduction is seen as a strategic maneuver to stimulate economic activities by lowering borrowing costs for consumers and businesses alike. With the Fed’s focus on managing inflation and stimulating growth, the reduction serves as a crucial intervention amid fluctuating economic conditions.

Additionally, this rate cut represents a pivotal shift, marking the first adjustment in four years, highlighting a proactive stance taken by Fed Chairman Jerome Powell. The intent behind such a significant cut is to ensure economic balance, encouraging consumer spending while attempting to avert a potential downturn. Understanding these changes is essential for consumers, especially those grappling with credit card debt or looking to make significant purchases like homes or cars.

Impact of Lower Interest Rates on Consumers

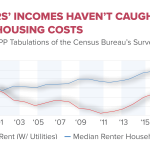

Lower interest rates often translate to immediate benefits for consumers, particularly in terms of mortgage rates. With the Federal Reserve’s decision to cut rates, prospective homebuyers can look forward to more attractive mortgage options, potentially easing the grip of the ongoing housing affordability crisis. Lower mortgage rates can empower consumers to purchase homes, thereby invigorating the real estate market and enhancing overall economic growth.

Moreover, consumers burdened with high credit card debt can expect some relief as interest rates decrease. As borrowing costs decline, the existing debt becomes less onerous, enabling consumers to allocate their budgets towards savings or additional investments. The broader impacts on consumers from this rate cut will unfold over time, but the immediate reaction could herald a more favorable economic environment for household financial health.

The Relationship Between Rate Cuts and Mortgage Rates

Historically, when the Federal Reserve implements interest rate reductions, mortgage rates tend to follow suit, albeit with inherent delays. As seen in the current economic scenario, the anticipation of the Fed’s policy changes has already led to a decrease in mortgage rates. This trend is likely to continue as the Fed eases its monetary policy, fostering a more favorable environment for prospective buyers.

The ongoing adjustment in mortgage rates plays a critical role in addressing the housing affordability crisis that many consumers face. With lower rates, homebuyers might seize the chance to invest in properties, subsequently boosting demand in the housing market. However, it’s important to remain cautious, as shifts in the economic environment could reverse these trends, requiring consumers to stay informed and strategic in their financial decisions.

Economic Growth and The Potential for Further Rate Cuts

The Federal Reserve’s current rate cut signals an effort to spur economic growth amidst a delicate balance of inflation control. Economists like Jason Furman suggest that this policy shift could lead to an uptick in job creation and business investment over the next several months. A robust economy hinges on consumer spending; thus, the Fed’s actions are geared toward fostering that growth through lower borrowing costs.

Moreover, the prospect of further rate cuts by the end of the year adds another layer of optimism for consumers and businesses alike. If economic conditions warrant, these additional cuts could solidify the foundation for more substantial growth. Yet, with inflation being a double-edged sword, the Fed’s maneuvering will require a keen observation of upcoming economic data to assess the appropriate course of action.

Credit Card Debt Relief Through Rate Reduction

For consumers grappling with escalating credit card debt, the recent interest rate reductions from the Federal Reserve provide a glimmer of hope. Lower interest rates can considerably alleviate monthly payments, allowing consumers to focus on paying down principal balances rather than accruing interest. This relief is especially critical for consumers who have been struggling with high levels of debt.

However, while the outlook is favorable, it’s essential for consumers to manage their spending habits judiciously. With unpredictable elements, such as inflation and potential rate adjustments looming, consumers are encouraged to create debt repayment strategies that align with their financial goals. Emphasizing responsible borrowing combined with the benefits from the recent rate cut can lead to a more favorable financial future for many.

Reactions from Wall Street and Main Street

The Federal Reserve’s decision to cut rates resonates through both Wall Street and Main Street, affecting various sectors and consumer segments. Wall Street participants often view such decisions as signals for future investment opportunities, as lower borrowing costs may lead to increased corporate profits. This can drive stock prices upward and create a more robust market environment.

Conversely, for Main Street consumers, the implications are immediate and personal. As rates decline, there is more room for financial maneuvering—whether through cheaper loans, improved credit card terms, or increased purchasing power. Understanding the interconnectedness of these two economic realms can provide consumers with a clearer picture of how rate cuts influence their day-to-day financial decisions.

Implications for Businesses Post-Rate Cut

Businesses are expected to perceive the Federal Reserve’s rate cut as a propelling factor for growth and expansion. Lower interest rates can facilitate easier access to financing, allowing companies to invest in infrastructure, technology, and workforce development. As firms begin to expand, the broader economic landscape can experience a ripple effect, fostering job creation and stimulating demand.

However, the immediate impact may be modest, with businesses likely to feel more substantial effects over the upcoming months. Optimizing operational strategies in response to decreased borrowing costs can be pivotal for firms aiming to navigate the current economic climate, and exploring new growth avenues can enhance competitive advantages.

Consumer Expectations Following Rate Cuts

As consumers adapt to the new economic landscape shaped by rate cuts, expectations will sway between optimism and apprehension. The promise of lower mortgage rates simultaneously mixes with concerns over persistent inflation and market fluctuations. This scenario underscores the importance of strategic financial planning, ensuring that consumers can navigate their personal finance effectively despite economic uncertainties.

Moreover, consumer sentiment will play a crucial role in economic recovery. If consumers feel confident in their financial standing and borrow more freely, they can drive spending and invigorate economic growth. However, if they remain cautious due to fear of recession—all variables that depend on ongoing Fed policies—economic recovery may face hurdles. Thus, understanding consumer behavior in response to these rate cuts becomes essential.

Outlook on Inflation and Future Rate Adjustments

With the Fed’s recent decisions surrounding rate cuts, inflation remains a primary concern to monitor. As lower interest rates could potentially spur economic activity and increase spending, there is also the risk of inflation gaining momentum. This duality requires careful monitoring and a balanced approach from policymakers to stimulate growth while keeping inflation in check.

The anticipation of future adjustments to the federal funds rate will depend heavily on economic indicators, labor market reports, and inflation trends. Should inflation trends race beyond acceptable levels, the Fed may need to recalibrate its approach, which could reverse some of the benefits of rate cuts. Keeping an eye on these developments is crucial for consumers and businesses alike as the economic landscape continues to evolve.

Frequently Asked Questions

What is the impact of the Federal Reserve rate cut on consumers?

The Federal Reserve rate cut is expected to benefit consumers by lowering borrowing costs. This could lead to reduced interest rates on mortgages and credit cards, making it easier for consumers to manage their debts. While the extent of these benefits may vary, the clarity in messaging from the Fed suggests that they are committed to supporting economic stability and consumer spending.

How will the Federal Reserve rate cut affect mortgage rates?

The Federal Reserve rate cut typically leads to lower mortgage rates as it reduces the overall cost of borrowing. Following this recent cut, experts anticipate that mortgage rates may continue to decline, which could provide significant relief for homebuyers and improve housing affordability.

Will the Federal Reserve rate cut stimulate economic growth?

Yes, the Federal Reserve rate cut is designed to stimulate economic growth by making borrowing cheaper for consumers and businesses. This could enhance consumer spending, encourage investment, and ultimately contribute to stronger job creation over the next year.

What are the implications of the Federal Reserve rate cut for credit card debt relief?

The Federal Reserve rate cut may lead to lower interest rates on credit card debt, providing relief for consumers struggling with high balances. However, since credit card rates depend on various factors, including risk and repayment expectation, immediate relief may not be evident, and rates might remain high for some time.

How often can we expect the Federal Reserve to cut rates following this announcement?

Following the recent Federal Reserve rate cut, analysts expect the possibility of two more cuts by the end of the year. However, the Fed will closely monitor economic indicators and inflation before making any further adjustments, indicating a cautious approach toward future reductions.

| Key Points |

|---|

| The Federal Reserve cut rates by half a percentage point, its first reduction in four years, benefiting consumers with credit card debt, car loans, and prospects of lower mortgage rates. |

| Chairman Jerome Powell noted the economy is “strong overall” while signaling potential further cuts depending on inflation and labor market conditions. |

| Jason Furman expressed that while the reduction was larger than anticipated, it indicates the Fed’s adaptability to economic circumstances and aims to prevent a recession. |

| The Fed is likely to enact two more cuts by year-end, although they remain cautious about inflation’s trajectory. |

| For consumers, the impacts on credit card and loan rates may take longer to materialize, with high rates potentially persisting for another year. |

Summary

The Federal Reserve rate cut marks a significant step in adjusting the monetary policy landscape, aimed at bolstering economic growth while keeping inflation in check. As the Fed’s monetary easing begins to take effect, consumers can look forward to potential reductions in mortgage and loan interest rates. However, the actual benefits for everyday borrowers may manifest gradually, reflecting the complexity of financial markets. With further cuts anticipated, the Fed aims to navigate potential economic challenges without stoking inflation, thus striving for a balanced recovery.