Corporate tax rates play a crucial role in shaping the economic landscape, influencing business decisions and government revenue. As Congress prepares for the anticipated 2025 tax battle, the implications of the 2017 Tax Cuts and Jobs Act are at the forefront of discussions among policymakers. Harvard economist Gabriel Chodorow-Reich highlights that, while the act’s cuts were intended to stimulate investments, they led to a significant decrease in corporate tax revenue, raising questions about their long-term effectiveness. With key provisions set to expire soon, including the expanded Child Tax Credit, voters are increasingly concerned about the impact of these tax policies on their financial well-being. As the debate intensifies, understanding the intricacies of corporate tax rates becomes essential for predicting future economic outcomes.

When discussing the financial obligations of corporations, terms like corporate taxation or business tax structures come to mind. The ongoing shift in tax policies and structures affects not just large entities but the overall economy as well. As the debate heats up regarding the 2025 fiscal regulations, the consequences of past reforms, such as those enacted under the Tax Cuts and Jobs Act, will shape the dialogue significantly. Economists and policymakers alike are re-evaluating the effectiveness of reduced rates in stimulating growth and the pivotal role of provisions like the Child Tax Credit. Insights from key figures in the field, such as Gabriel Chodorow-Reich, will be essential in navigating these complex tax matters.

The Impact of the Tax Cuts and Jobs Act on Corporate Tax Rates

The Tax Cuts and Jobs Act (TCJA), enacted in 2017, fundamentally changed corporate tax rates in the United States, slashing them from 35% to 21%. This historic reduction aimed to invigorate the economy by stimulating business investments and fostering growth. Harvard economist Gabriel Chodorow-Reich’s recent analysis highlights that while some businesses indeed increased their capital investments post-TCJA, these gains were insufficient to balance the staggering decline in federal corporate tax revenue. For instance, the act was projected to slash corporate tax revenues by an alarming $100 billion to $150 billion annually over the next decade. Thus, the legislative intent behind lowering corporate tax rates sparked ongoing debates about the actual efficacy of such cuts in enhancing economic vitality and job creation.

Furthermore, the TCJA’s significant impact extends beyond just immediate tax revenue implications. As more provisions set to expire by 2025 emerge as critical points of contention in the upcoming tax battle, the discourse within Congress is heating up. With the expiration of beneficial elements like the expanded Child Tax Credit and cuts directed at low- and middle-income households, the dialogue surrounding corporate tax rates has become more contentious. Chodorow-Reich suggests that legislators may need to reassess their strategies, weighing the potential revenue from raised corporate rates against the need for a more equitable tax structure to support working-class Americans.

Corporate Tax Revenue Trends Post-TCJA

In the wake of the TCJA, corporate tax revenue initially plunged dramatically, dropping approximately 40% shortly after the reforms took effect. This decline elicited skepticism regarding the efficacy of tax cuts in generating increased fiscal contributions from corporations. However, a notable rebound commenced in 2020 when corporate tax revenue experienced an unexpected surge, largely due to the booming business profits during and after the pandemic. Many economists, including Gabriel Chodorow-Reich, have expressed the necessity for more comprehensive research to unravel the underlying factors that drove this resurgence. Some hypotheses suggest that structural shifts in supply chains and emerging inflationary pressures may have coerced companies to rethink their financial reporting and profitability strategies in the U.S. market.

The reconceptualization of profit-reporting strategies has critical ramifications for understanding true corporate tax revenue dynamics. With multinationals, such as Google’s parent company Alphabet, shifting more profits back to U.S. accounts—partly due to the TCJA’s favorable tax environment—we witness a trend that contradicts earlier skepticism regarding corporate gains post-TCJA. As businesses adapted to novel market conditions, the result was an unanticipated rise in tax revenue at a time when many had expected persistent downturns. This phenomenon has likely influenced the ongoing dialogues among policymakers debating the future trajectory of corporate tax rates and tax policy reforms.

The Role of Corporate Tax Rates in Economic Growth

Debates surrounding corporate tax rates often pivot on their potential to drive economic growth. Proponents of lowering tax rates argue that such measures incentivize companies to reinvest profits, thereby spurring innovation and job creation. However, Chodorow-Reich’s findings reveal a more complex picture: while corporate tax cuts did appear to boost capital investments by around 11%, these increases were not sufficient to offset the major reductions in tax contributions. The findings suggest a careful balance must be struck—between encouraging investment through lower rates and ensuring that the government retains enough revenue to fund public initiatives and support lower-income households.

Moreover, the notion that corporate taxes universally stifle growth may also be misleading. Chodorow-Reich’s analysis indicates that data shows corporate policies are indeed influenced by tax regulations. This insight challenges the school of thought that corporate tax rates can be raised without consequence. As Congress deliberates on the potential for higher corporate taxation, the necessity of integrating successful provisions from the TCJA, such as immediate expensing deductions, could be pivotal in formulating a balanced approach that fosters growth while securing essential public revenues.

Evaluating the Child Tax Credit in Relation to Corporate Tax Cuts

In parallel with the contentious discourse surrounding corporate tax rates, discussions on the Child Tax Credit amplify the urgency for reform as its expanded provisions face expiration at the end of 2025. Advocates for the Child Tax Credit, including Democrats, argue that enhancing benefits for families is essential for reducing poverty and increasing disposable income, which in turn supports consumer spending—an economic driver. Contrastingly, some policymakers prioritize measures that favor corporate tax cuts, which they assert can lead to increased job creation. However, Chodorow-Reich’s research indicates that these two objectives are not mutually exclusive; there’s room for both corporate reform and support for families through tax credits.

Reassessing the Child Tax Credit in the context of corporate tax cuts illustrates a potential path towards bipartisan cooperation. While corporations benefit from reduced tax burdens, families should likewise receive benefits that secure their financial welfare. Such a dual-focus approach can create a more balanced economic framework that prioritizes equity while driving growth. By lobbying for adequately funded months ahead of elections, advocates can better position initiatives like the Child Tax Credit alongside necessary dialogues about corporate tax rates, thereby championing a narrative that transcends partisan disagreement.

Investigating the Future of Tax Legislation Beyond 2025

As the deadline to renew portions of the TCJA approaches, anticipation builds around the potential tax battle that will shape the political landscape moving into 2025. The expiration of critical provisions including the expanded Child Tax Credit raises pressing questions about future fiscal policy and its implications for both individuals and corporations. The needs of the electorate may lead to diverse proposals—ranging from removing tax cuts bestowed under the TCJA to reintroducing certain benefits. This landscape presents an opportunity for economists and policymakers alike to reconsider the relationship between tax structures and their socioeconomic outcomes.

Evaluating the TCJA’s performance could serve not only as a historical lens but as a foundational element for future reform discussions. Policymakers might examine the fiscal responsibility demonstrated during the TCJA era, gauging tangible benefits against revenue losses. Hence, the potential to reshape tax codes demands comprehensive analyses, not only highlighting corporate behaviors but also assessing employers’ roles in wage increases. In a polarized Congress, finding common ground could elucidate paths toward tax reform that accommodates both corporate interests and the needs of American families.

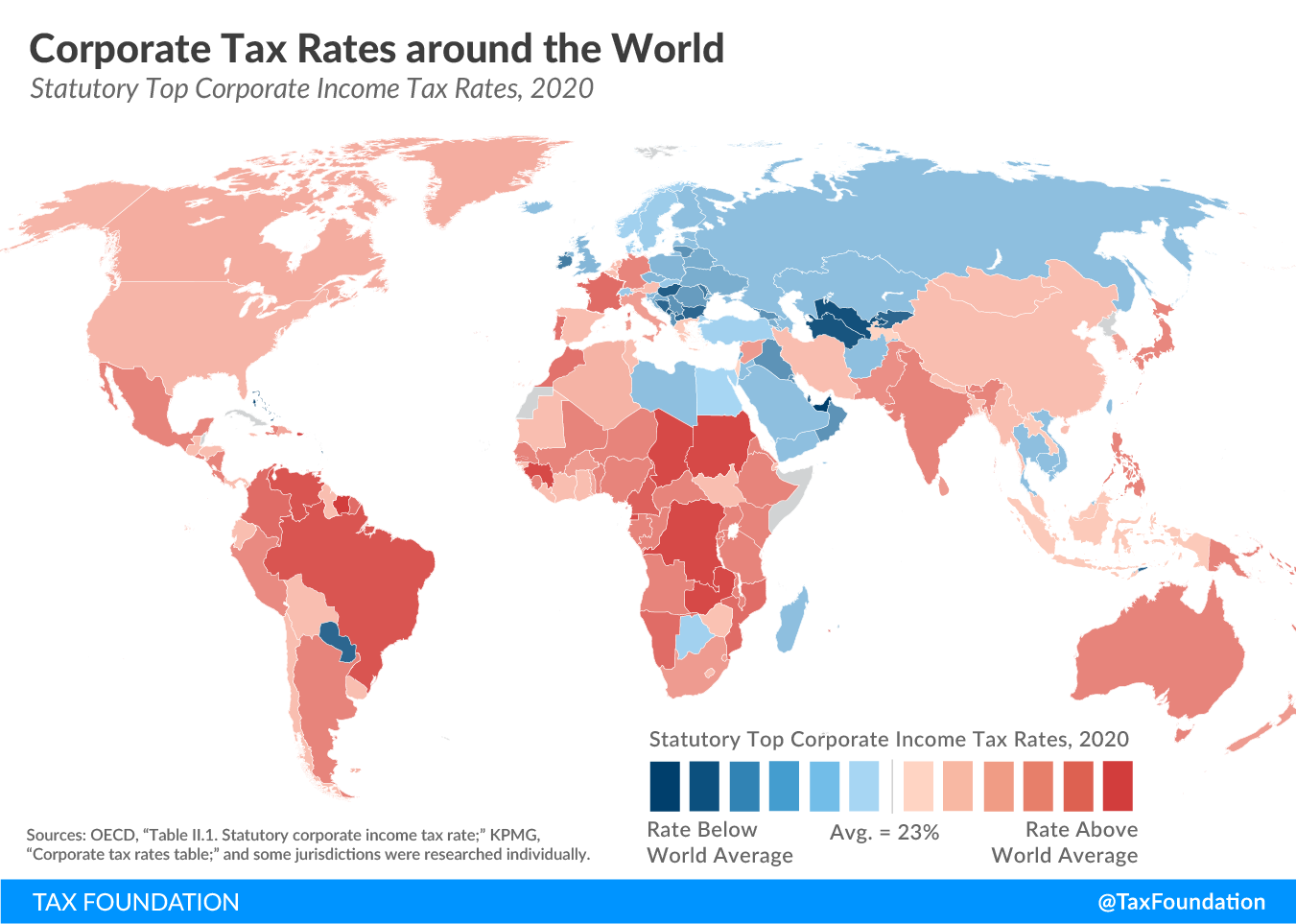

How Global Tax Trends Influence U.S. Corporate Tax Policy

In an increasingly globalized economy, the juxtaposition of U.S. corporate tax policies with international trends becomes pivotal. Historical trends reveal that many countries have been actively reducing their corporate tax rates to remain competitive. As Gabriel Chodorow-Reich noted, the U.S. was among the worst performers in 2016, with corporate tax rates significantly higher than most other wealthy nations. This competitive landscape pressures lawmakers to reevaluate and possibly align U.S. tax codes with more favorable international rates. The urgency becomes particularly pronounced as nations shift strategies in response to recent economic challenges.

Understanding these dynamics is essential for American corporations that operate globally. If U.S. tax policy remains rigid while other countries adapt through lower tax rates, there’s a risk of capital fleeing to jurisdictions with more favorable conditions. To secure its position, the U.S. might need to consider reforms not solely focused on revenue but on an economy that thrives on competitive corporate environments. Legislative strategies that encompass both moderate hikes in corporate tax rates complemented by incentives aimed to retain business investment within the country could be a tactical response to these international pressures.

The Necessity of Empirical Evidence in Tax Policy Discussions

The ongoing debate surrounding tax reform, especially concerning corporate tax policies, underscores the need for robust empirical evidence to guide decision-making. Gabriel Chodorow-Reich’s analysis compels lawmakers to ground their proposals in observable data rather than partisan ideologies alone. Research outcomes, including studies assessing the TCJA’s impacts, illuminate the granular effects of tax changes on corporate behavior and economic vitality. Such empirical approaches can alleviate political posturing and foster constructive discussions aimed at beneficial reforms.

Enhanced reliance on empirical evidence ensures nuanced conversations that incorporate various perspectives and economic realities. Lawmakers can create a more vibrant dialogue around corporate tax rates by supporting research initiatives and engaging economists with diverse viewpoints. This approach cultivates a more informed electorate as well, facilitating discussions that transcend divisive politics. With the looming 2025 tax battle on the horizon, grounding arguments in data, rather than dogma, can enrich the legislative outcomes that shape the economic landscape.

Revisiting Corporate vs. Individual Tax Impacts

As discussions intensify around revising both corporate and individual tax structures, the essential question arises: how do corporate tax rates impact individual taxpayers? Conventional wisdom posits that reductions in corporate taxation lead to net benefits for workers through job growth and wage increases. However, empirical assessments by economists like Chodorow-Reich present complex interactions between corporate taxation and wage dynamics, suggesting that the anticipated benefits of tax cuts may not uniformly translate into increased disposable income for individuals. This realization necessitates a careful examination of how corporate tax policies reflect in the economic security of families.

In light of this complexity, lawmakers should explore avenues where corporate and individual tax reforms coexist symbiotically. By implementing policies that simultaneously address corporate tax rates and direct benefits to households, it becomes possible to foster an economic environment that uplifts all segments of society. As evidenced by Chodorow-Reich’s research, a combination of increased investments in companies alongside supportive tax measures for families could maximize overall economic prosperity. This collaborative approach could redefine the narrative surrounding tax policy and its hypothetical movements in the near future.

The Role of Tax Revenue in Funding Public Services

Tax revenues directly impact the government’s capacity to fund public services including education, healthcare, and infrastructure. As the TCJA culminated in a substantial decrease in corporate revenue, numerous public initiatives faced budgetary constraints, with some programs set to dissolve as tax cuts expire in 2025. With ongoing discussions about raising corporate tax rates, the conversation must also encompass the concomitant benefits this could yield. Increased tax revenue could enhance funding for public services and enable broader social safety nets that provide essential support to American families.

Furthermore, the approach to tax revenue shouldn’t merely be about balancing budgets but enhancing the prosperity of communities. A well-resourced public sector, funded through equitable tax contributions, empowers citizens and cultivates economic growth. Meanwhile, investments in programs like the Child Tax Credit can serve as a powerful tool for alleviating poverty and revitalizing communities. As lawmakers navigate through the complexities of Corporate Tax Rates and public financing, fostering a society that adequately supports its infrastructure and citizens should remain at the forefront of legislative efforts.

Frequently Asked Questions

What impact did the Tax Cuts and Jobs Act have on corporate tax rates in the United States?

The Tax Cuts and Jobs Act (TCJA), implemented in December 2017, permanently lowered the corporate tax rate from 35% to 21%. This significant reduction aimed to enhance competitiveness by aligning U.S. tax rates more closely with global standards. However, it also led to a projected decrease in federal corporate tax revenue by $100 billion to $150 billion annually over the next decade.

How might the 2025 tax battle affect future corporate tax rates?

As key provisions of the TCJA, including the lower corporate tax rate, are set to expire at the end of 2025, the upcoming tax battle will determine whether these rates will be renewed, increased, or restructured. Discussions in Congress are likely to focus on balancing corporate tax rates with other tax benefits, such as the Child Tax Credit.

Who is Gabriel Chodorow-Reich and why is his analysis of corporate tax revenue relevant?

Gabriel Chodorow-Reich is a Harvard macroeconomist who analyzed the implications of the TCJA on corporate tax revenue. His research, published in the Journal of Economic Perspectives, highlights that while corporate tax rates were cut, the expected increases in wages and investments were modest, challenging the notion that tax cuts inherently pay for themselves.

What are the arguments for raising corporate tax rates in the context of the TCJA?

Proponents of raising corporate tax rates argue that higher rates could provide necessary funding for social initiatives and help offset the significant revenue losses incurred since the TCJA’s implementation. Advocates, including policymakers like Kamala Harris, suggest that increasing rates can ensure a more equitable tax system while still promoting economic growth.

How did corporate tax rates under the TCJA affect business investments?

While the TCJA’s tax cuts were meant to incentivize business investments, the research by Chodorow-Reich and his colleagues indicates that the most effective drivers of investment were temporary expensing provisions rather than the statutory rate cuts. These measures encouraged firms to invest in capital more successfully than the lower tax rates alone.

What is the relationship between corporate tax rates and wage growth as highlighted by recent studies?

Studies, including those by Gabriel Chodorow-Reich, suggest that while tax cuts, such as those from the TCJA, were expected to spur significant wage growth, the actual effects were modest. While some wage growth occurred due to increased investments, the increases were lower than projected, highlighting the complex dynamics between corporate tax rates and wage growth.

How might changes to corporate tax rates in 2025 impact household initiatives like the Child Tax Credit?

As corporate tax rates are debated in Congress, any changes could directly impact funding for various household initiatives, including the Child Tax Credit. Renewing or raising corporate rates could provide additional revenue that lawmakers could allocate to such social programs, crucial for middle and low-income families.

What are the potential consequences of the sunset provisions of the TCJA for corporate tax revenue?

If the sunset provisions of the TCJA take effect and the corporate tax rates revert to higher levels, there could be an increase in corporate tax revenue. However, this could also lead to business uncertainty and potentially dampen investment activity, thus impacting overall economic growth.

Why are corporate tax rates considered a critical factor in economic policy discussions?

Corporate tax rates are central to economic policy as they affect business behavior, investment decisions, and overall economic growth. They influence how competitive the U.S. economy is globally, which is why debates around changes, such as those proposed amidst the TCJA, are pivotal in shaping economic strategies.

| Key Points | Details |

|---|---|

| Corporate Tax Debate | Congress faces a tax battle in 2025 regarding the expiration of provisions from the Tax Cuts and Jobs Act (TCJA), including corporate tax rates. |

| 2017 Tax Cuts and Jobs Act (TCJA) | The TCJA reduced the corporate tax rate from 35% to 21% and aimed to facilitate business growth. |

| Economic Impact | While there were modest increases in wages and business investments, the tax cuts did not significantly offset the drop in tax revenue. |

| Partisan Perspectives | Democrats advocate for raising corporate tax rates while Republicans push for further cuts, reflecting a divided approach to corporate taxes. |

| Future Implications | Chodorow-Reich’s analysis suggests that reforms may be necessary to balance revenue while promoting business investment. |

Summary

Corporate tax rates are currently at the center of a heated debate as Congress prepares for discussions in 2025. The dynamics surrounding corporate taxation are shaped by the expirations of key provisions from the 2017 Tax Cuts and Jobs Act. With various parties passionately advocating for their views, understanding the impact of previous tax cuts and the potential revisions is crucial for addressing fiscal responsibility while fostering economic growth.