The implications of China tariffs impact extend beyond simple trade disputes; they reverberate throughout the entire U.S. economy. As the United States contemplates heavy tariffs on Chinese imports, the potential for significant economic repercussions grows. Economists warn that such measures could lead to higher consumer prices and supply chain disruptions, ultimately affecting everyday Americans. Additionally, these trade war consequences might weaken U.S. foreign relations with traditional allies, as they navigate their own ties with China amidst rising tensions. Understanding the broader effects of these tariffs is crucial, as they could alter the landscape of American commerce for years to come.

When examining the repercussions of tariff policies on China, one cannot ignore their broader influence on the American market and international relations. The potential for escalating trade conflicts could disrupt critical supply chains, leading to increased costs for goods and services. Analysts speculate that the ongoing trade tensions might reshape U.S. ties with foreign nations, as allies reassess their strategies in light of shifting trade dynamics. Furthermore, as China grapples with its own economic challenges, the interplay between tariffs and market forces may have far-reaching implications for both nations. Thus, exploring the nuances of these tariff discussions provides valuable insights into the future of global commerce.

Impact of China Tariffs on the US Economy

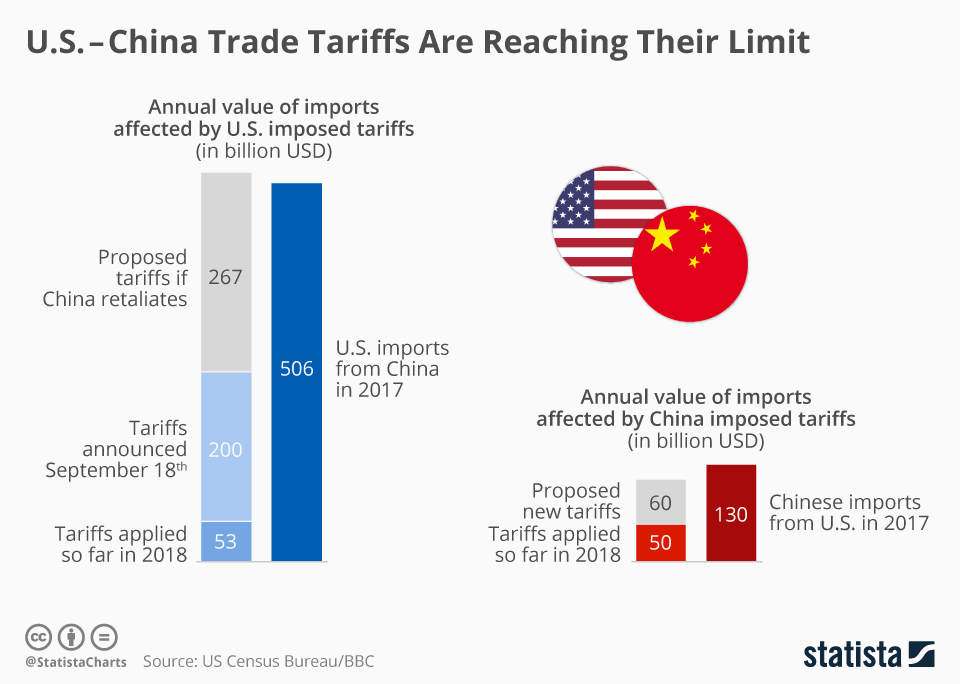

The imposition of heavy tariffs on Chinese imports has significant and potentially detrimental effects on the U.S. economy. Economists warn that while the tariffs may appear to be a strategic move aimed at pressuring China, they could instead lead to inflated prices for American consumers. This is particularly alarming given the existing inflationary trends that have already strained household budgets. The increase in tariffs will likely mean that businesses passing along these costs to consumers will result in higher prices across various sectors — from electronics to everyday consumer goods. Furthermore, tariffs on Chinese imports could disrupt supply chains that are finely tuned and reliant on Chinese components, leading to material shortages and delays in manufacturing.

Moreover, the long-term economic consequences of imposing steep tariffs could include labor shortages due to increased costs of living and production. As companies grapple with higher import taxes, they may cut back on hiring or even reduce their workforce to maintain profit margins. This scenario creates a ripple effect, where decreased employment levels could lead to reduced consumer spending, which, in turn, exacerbates economic slowdowns. With potential instability in U.S. foreign relations as a backdrop, the economic fallout from these tariffs may be more profound than initially anticipated.

Supply Chain Disruptions Caused by Tariffs

The introduction of increased tariffs on Chinese imports is expected to significantly disrupt U.S. supply chains, which have become heavily reliant on Chinese manufacturing. The complexity of global production networks means that a tariff on one element of the supply chain can have a cascading effect, influencing the availability and cost of final goods. There are concerns that manufacturers will struggle to find alternative suppliers that can match the efficiency and cost-effectiveness of Chinese producers. As companies seek to navigate these disruptions, they may experience delays, increased operational costs, and necessitate a reevaluation of their sourcing strategies.

In particular, industries such as electronics, automotive, and consumer goods are at risk of facing production halts or delays due to the sudden increased cost of imported materials. For instance, the tech industry is especially vulnerable because many of its components are sourced from China. Therefore, as tariffs raise the cost of these essential components, U.S. companies may have to shift their production bases to countries like Vietnam or India, which could take time to scale up sufficiently to meet demand. Such changes not only affect the American consumer directly through slower deliveries and higher prices, but they also reshape the entire landscape of global trade dynamics.

Trade War Consequences for US Foreign Relations

The escalating trade war between the U.S. and China due to tariffs has far-reaching implications for U.S. foreign relations. As the U.S. adopts a more aggressive tariff policy, it risks alienating traditional allies who may find themselves caught in the crossfire. For example, countries in the European Union, which have longstanding trade relationships with both the U.S. and China, might respond negatively to what they perceive as an isolationist stance from the U.S. This could result in a reevaluation of existing alliances, opening the door for China to strengthen ties with those nations affected by American tariffs.

Furthermore, the tariffs may inadvertently push countries like Japan and Australia to reconsider their economic partnerships with the United States in favor of developing closer ties with China. This shift could lead to a more interconnected Chinese economy with other global players, lessening the historical geopolitical influence of the U.S. As nations navigate their economic interests, the U.S. risks losing its role as a dominant player on the world stage if they perceive its trade policies as aggressive rather than cooperative.

Potential Benefits for Other Countries Amidst Decreased Chinese Imports

As U.S. tariffs on Chinese goods escalate, other countries are eyeing the opportunity to fill that gap left by Chinese exports. Nations like Vietnam and India may stand to gain from a decrease in Chinese imports, as they could attract more investment and trade opportunities. For Vietnam, which has already begun to position itself as a manufacturing hub, the potential to absorb markets that traditionally relied on Chinese imports could further enhance its economic growth. However, the transition may not be seamless, as Vietnam will face its challenges in expanding production capabilities to meet U.S. standards.

Similarly, India is looking to capitalize on this opportunity by promoting its manufacturing sector through initiatives like ‘Make in India.’ This strategic push aims to invite foreign direct investment into various industries, ultimately aiming to replace lost Chinese exports. While these nations may benefit in the short term, they must also contend with the complexity of reshaping existing supply chains that have long favored China. The emergence of new trade relationships could lead to interesting developments in global supply chains and alignment, potentially easing dependence on Chinese manufacturing in the future.

Long-term Economic Strategies Post-Tariffs for China

China’s economic strategy in response to increasing tariffs from the U.S. must adapt to ensure its continued growth and stability. With U.S. tariffs potentially constraining Chinese exports, China could increasingly rely on domestic consumption and innovation to fuel its economy. This shift would necessitate structural changes in policies that support consumer spending, such as stimulating the middle class and increasing disposable income. The Chinese government has already been moving towards this strategy, albeit cautiously, as it still values its trade surplus.

Additionally, diversifying its trade networks through initiatives like the Belt and Road Initiative (BRI) could mitigate some of the impacts of decreased American demand. By building stronger economic ties with countries in Southeast Asia, Africa, and Latin America, China could establish alternative markets for its goods and services. This approach not only buffers China against potential economic fallout from U.S. tariff policies but also enhances China’s geopolitical influence across multiple regions, potentially creating a multipolar global market.

Navigating the Future of US-China Trade Relations

The future of U.S.-China trade relations hinges on several factors, including the willingness of both nations to engage in constructive dialogue amid escalating tensions. If the U.S. continues down the path of imposing high tariffs on Chinese imports, it may set the stage for prolonged confrontations that could stifle collaboration on global challenges, such as climate change and health crises. Engaging in negotiations with the Chinese government to address underlying trade grievances without resorting to punitive measures could yield more sustainable and mutually beneficial outcomes.

As both countries maneuver through this complicated landscape, public sentiment in the U.S. will play a crucial role in shaping trade policy decisions. Increased awareness about the repercussions tariffs have not only on American consumers but also on the stability of global supply chains could pressure policymakers to adopt a more balanced approach. Finding common ground to revitalize trade relationships could lead to a reimagined economic partnership that benefits both nations and restores stability in international relations.

Addressing Labor Shortages and Economic Stability Due to Tariffs

The ongoing trade tensions and tariff measures threaten to exacerbate existing labor shortages in the U.S. job market, particularly in sectors heavily reliant on international supply chains. Increased tariffs can lead to decision-making where firms prioritize cost-cutting over hiring, resulting in fewer job opportunities and wage stagnation. This cycle can create a feedback loop that stifles economic growth as consumers have less purchasing power amidst rising costs and reduced job security.

Moreover, if American companies struggle to find alternative suppliers to replace goods and materials sourced from China, it could lead to production cuts and an acceleration of offshoring jobs to mitigate costs. This trend not only undermines domestic job security but also places additional pressure on wages, as labor competition increases in underdeveloped markets. Addressing labor shortages amidst escalating tariffs requires strategic approaches, such as enhancing skills training and investing in workforce development programs, to prepare the American labor force for the projected shifts in industry needs.

Role of Consumer Sentiment in Economic Recovery Amidst Tariffs

Consumer sentiment is a driving force in economic recovery, especially in the wake of increased tariffs and rising prices. If consumers grow apprehensive about the ramifications of tariffs on their purchasing power, it can stifle economic activity as they tighten household budgets in response to inflationary pressures. The chilling effect on spending can lead businesses to scale back production and investment plans, creating a self-fulfilling cycle of economic stagnation.

Moreover, understanding consumer perceptions about tariffs and their potential long-term effects on economic recovery is essential for businesses to navigate this complex climate. Companies may need to focus on transparency and diligent communication about how tariffs influence prices to maintain customer trust and loyalty. A strong focus on value propositions can give businesses a competitive edge in a tightening consumer market, ultimately aiding in stabilizing economic conditions as consumer confidence plays a pivotal role in driving recovery.

Building Resilience in Supply Chains Against Future Tariff Challenges

Given the unpredictability of trade policies and tariffs, businesses need to build resilience in their supply chains to safeguard against future disruptions. This includes diversifying suppliers, investing in local production, and fostering strategic partnerships in various geographical areas and markets. By reducing reliance on a single source of imports, companies can better navigate tariff structures and ensure steady access to critical materials.

Additionally, embracing technology to enhance supply chain transparency can aid businesses in making informed decisions in real-time. Utilizing advanced data analytics and predictive modeling can enable firms to assess potential tariff impacts and quickly adapt their sourcing strategies accordingly. As the global marketplace continues to evolve, adaptive supply chains that can withstand shocks will be essential for maintaining business continuity and ensuring sustained economic growth.

Frequently Asked Questions

What is the impact of China tariffs on the US economy?

The impact of China tariffs on the US economy can lead to increased prices for consumers and supply chain disruptions. As tariffs raise the costs of Chinese imports, American companies may pass these costs onto consumers, leading to inflation. Additionally, industries relying on imported goods from China may face delays and challenges in sourcing materials, further complicating supply chains.

How might the US-China trade war affect US foreign relations?

The US-China trade war may strain US foreign relations, particularly with traditional allies in Europe and Asia. Imposing tariffs on Chinese goods could lead to a realignment of trade partnerships, as countries like Japan and Australia might strengthen ties with China in response, potentially undermining US influence in these regions.

What are the potential supply chain disruptions caused by China tariffs?

Potential supply chain disruptions caused by China tariffs include delays in production, increased costs of raw materials, and a need for companies to source goods from alternative countries. As manufacturers adjust to tariffs, they may struggle to maintain efficiency, leading to longer lead times and higher prices for American consumers.

Could China tariffs deepen the strain on US-China relations?

Yes, China tariffs could deepen the strain on US-China relations by escalating economic tensions and prompting retaliatory measures from China. This tit-for-tat approach can hinder diplomatic efforts and complicate future negotiations, creating a cycle of conflict that impacts both nations economically and politically.

Which countries could benefit from reduced Chinese imports to the US due to tariffs?

Countries like Vietnam and India could benefit from reduced Chinese imports to the US as they may attract investment to fill the gaps left by China’s diminished role. However, establishing new supply chains will take time, and these countries must enhance their manufacturing capabilities to meet US product standards.

What are the broader consequences of increased tariffs on Chinese imports?

The broader consequences of increased tariffs on Chinese imports include potential retaliation from China and other nations, a reshuffling of global trade dynamics, and increased costs for American consumers. This could lead to a shift in the international economic landscape as countries seek new trade relationships away from the US.

How are American consumers likely to feel the impact of China tariffs?

American consumers are likely to feel the impact of China tariffs through higher prices on goods imported from China. As tariffs increase, businesses may raise prices to maintain profit margins, leading to more expensive everyday products and potentially reducing consumers’ purchasing power.

What role do tariffs play in shaping US-China trade relations?

Tariffs play a significant role in shaping US-China trade relations by acting as a pressure mechanism in trade negotiations. The imposition of tariffs often reflects broader political strategies and can impact not just trade flows but also diplomatic relations, reshaping how these two economic powers interact on the global stage.

Are there alternatives to Chinese imports for U.S. businesses amidst tariff changes?

Yes, alternatives to Chinese imports for U.S. businesses include sourcing from countries like Vietnam, India, and Mexico, which may offer similar products without the added tariff costs. However, companies need to navigate complex supply chains and may face challenges in ensuring quality and compliance with US standards.

What measures is China taking to counter the effects of US tariffs?

China is taking several measures to counter the effects of US tariffs, including seeking new trade partnerships, boosting domestic consumption, and investing in alternative markets. Additionally, China may employ economic strategies like enhancing its Belt and Road Initiative to strengthen trade relationships with other nations.

| Key Points |

|---|

| Heavy tariffs on China could hurt China’s economy but also negatively impact the U.S. economy by raising consumer prices and causing supply chain issues. |

| Trump’s proposed tariffs aim to address illegal migration and drug influx, complicating U.S.-China relations further. |

| China’s economy is already struggling, and tariffs could significantly worsen export efforts, particularly in crucial U.S. markets. |

| Uncertainty over tariffs makes it difficult for China to plan, especially with complex rules around the origin of goods. |

| China is attempting to pivot towards other markets (e.g., EU, Japan) but will find it challenging to replace the U.S. trading relationship. |

| High-value manufacturing and components supply chains are complex and not easily replicated by other countries like India or Vietnam. |

| A broad tariff approach could inadvertently strengthen China’s ties with U.S. allies, as they band together against the U.S. sanctions. |

Summary

The potential impact of China tariffs illustrates the complex interdependence between the U.S. and Chinese economies. China tariffs impact the U.S. by raising consumer prices, disrupting supply chains, and altering foreign relations. As the U.S. considers imposing significant tariffs, it risks damaging not only its relationship with China but also its strategic ties with allies. The uncertainties that such tariffs bring could inadvertently facilitate greater cooperation between China and U.S. allies, reshaping international trade dynamics.