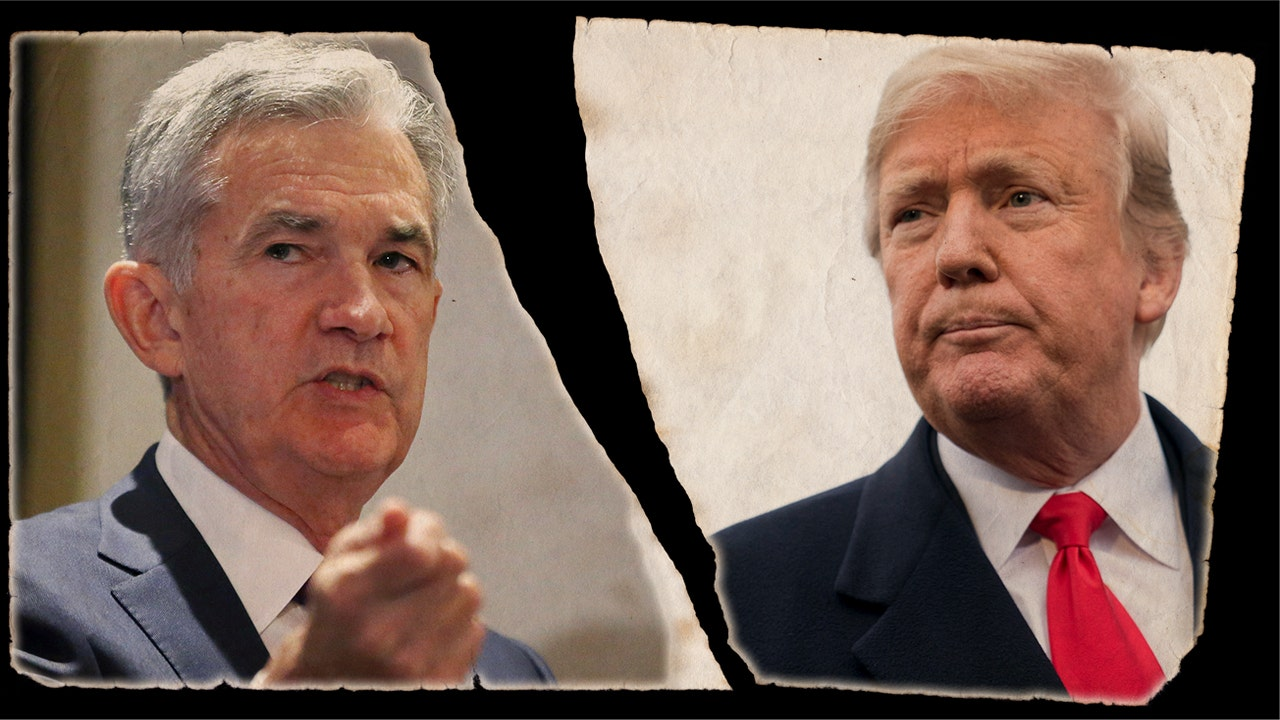

**Can Trump fire Fed chairman?** As the relationship between President Trump and Federal Reserve Chairman Jerome Powell has been marked by tension, the question looms large in political and economic discussions. Throughout his presidency, Trump has publicly criticized Powell, attributing slow economic growth and inflation concerns to the Fed’s cautious approach to interest rate adjustments. The intricacies of Federal Reserve independence suggest that while Trump has expressed discontent and even hinted at potentially ousting Powell before his term concludes, such a move could carry substantial risks. Analysts warn that the market reaction to Jerome Powell’s removal would likely be swift and severe, reflecting deep concerns over the erosion of central bank independence. As these developments unfold, it becomes imperative to explore the ramifications of executive power over the Federal Reserve and how they could affect financial stability and investor confidence.

The debate surrounding the potential dismissal of the Federal Reserve Chairman by a sitting president raises important questions about presidential authority and the economic impact of such decisions. In light of Trump’s critical stance towards Powell, especially concerning monetary policy decisions, speculations about Jerome Powell’s ousting have surfaced repeatedly. This scenario not only challenges the balance of power established within independent agencies but also stipulates the significance of maintaining the Federal Reserve’s autonomy. As market participants closely monitor the dynamics of the Trump and Powell relationship, the implications of any change in leadership could reverberate throughout the financial sector. Understanding the complexities of these interactions is vital in assessing both current and future economic stability.

Understanding Trump’s Power to Fire the Fed Chairman

The question of whether President Trump has the authority to fire the Federal Reserve Chairman Jerome Powell is complex and rooted in legal subtleties. The Federal Reserve Act, which was modified in the 1970s, includes provisions for the removal of governors under specific conditions labeled as ‘for cause.’ However, this amendment left ambiguities about the chair’s status and whether those protections apply to him, leading to intense debate among legal scholars and financial analysts alike. Given that Trump initially appointed Powell, concerns arise about whether his dissatisfaction could result in an executive decision to oust the chairman before his term concludes.

Moreover, interpreting the Supreme Court’s potential stance on the issue presents another layer of complexity. Historical precedents, particularly the 1935 case *Humphrey’s Executor*, suggest limited executive power over independent agencies like the Federal Reserve. Yet, as conservative justices hint at a re-evaluation of such decisions, including the potential for a carve-out where the Fed’s independence might be treated differently, the markets remain jittery. Ultimately, any move to dismiss the Fed chairman would likely trigger significant market reactions, underlining the balance of power between the executive branch and the established independence of federal institutions.

Frequently Asked Questions

Can Trump fire Fed chairman Jerome Powell if he disagrees with his policies?

While President Trump has expressed discontent with Fed Chairman Jerome Powell, legally firing him raises complex issues. The Federal Reserve Act allows for the removal of governors ‘for cause,’ but the Supreme Court’s interpretation of executive power over independent agencies like the Federal Reserve plays a crucial role. Thus, while technically possible, market reactions and legal considerations likely deter Trump from such a move.

What is the market reaction to the potential ousting of Fed chairman Powell?

The market reaction to the potential removal of Fed chairman Powell would likely be significant. An abrupt change in leadership at the Federal Reserve could undermine investor confidence and trigger volatility. Markets fear that presidential interference may lead to looser monetary policies, impacting interest rates and inflation expectations negatively.

Does Trump have the executive power to remove a Federal Reserve chairman?

The question of whether Trump can fire Fed chairman Powell revolves around executive power and legal interpretations of the Federal Reserve Act. While the act provides for removal ‘for cause,’ the law is nuanced and could be challenged in court, particularly given the constitutional implications of executive authority at independent agencies. Thus, it’s a legally gray area.

What implications would firing the Fed chairman have on Federal Reserve independence?

Firing Fed chairman Powell could severely undermine the Federal Reserve’s independence, a cornerstone of effective monetary policy. Such an action might suggest that monetary policy is subject to political influence, which could erode trust in the central bank’s ability to fight inflation and stabilize the economy, ultimately harming its credibility.

How does Trump’s relationship with Powell affect economic policy?

Trump’s tumultuous relationship with Fed chairman Powell has significant implications for economic policy. Disagreements over interest rates could manifest in pressure to adopt more accommodative monetary policies aimed at boosting short-term growth. This relationship influences market perceptions and the Federal Reserve’s decision-making processes, highlighting the complexities of political influence on fiscal stability.

What would happen if Trump tried to remove Powell amid ongoing economic uncertainty?

If Trump attempted to remove Powell during economic uncertainty, the potential backlash could exacerbate market volatility. Such a decision might signal to investors that the Fed’s independence is compromised, leading to increased long-term interest rates and diminished confidence in U.S. monetary policy.

Why is there a legal argument surrounding the ousting of Fed chairman Powell?

The legal argument regarding the ousting of Fed chairman Powell stems from historical interpretations of the Federal Reserve Act and recent Supreme Court decisions that challenge traditional understandings of executive removal powers over independent agencies. The undefined parameters of ‘for cause’ removal create a complex legal landscape that could be subject to significant judicial scrutiny.

How does Wall Street perceive the potential firing of the Fed chairman?

Wall Street perceives the potential firing of Fed chairman Powell with caution, as it may signal a shift towards a more politically motivated monetary policy. This perception could lead to increased uncertainty in the markets, influencing investment decisions and impacting overall economic stability.

What role does the Fed chairman play in shaping monetary policy?

The Fed chairman plays a pivotal role in shaping monetary policy, although not in isolation. While the chairman is a key figure in the Federal Open Market Committee (FOMC), effective policymaking involves building consensus among various board members and responding to economic indicators, demonstrating that the position, while influential, is collaborative.

Will the identity of Powell’s successor impact market stability?

The identity of Powell’s successor can impact market stability; however, if Powell is ousted, the mere act of removal may create initial turbulence regardless of the successor’s qualifications. Markets tend to focus more on the implications of such a move for monetary policy rather than the individual’s background.

| Key Points | Details |

|---|---|

| Can Trump Fire Fed Chairman? | The president has the authority to remove the Fed chairman, but the legality and potential consequences are complex. |

| Relationship Between Trump and Powell | Trump and Powell have had a contentious relationship, particularly over interest rates and economic policies. |

| Market Impact | Firing Powell could lead to market instability and a decline in the Fed’s independence, raising concerns about inflation. |

| Legal Questions | The Federal Reserve Act allows removal for cause, but the interpretation of ‘for cause’ regarding the chair is debated. |

| Supreme Court’s Role | It’s uncertain how the Supreme Court might rule on presidential powers over independent agencies like the Fed. |

| Public Perception | Markets fear that removal would imply a shift toward looser monetary policy, undermining trust in the Fed. |

| Future of Powell’s Term | With Powell’s term ending soon, the administration may opt to wait rather than risk market backlash. |

Summary

Can Trump fire the Fed chairman? The answer involves legal, political, and economic considerations. While President Trump does have the authority to remove Jerome Powell as chairman of the Federal Reserve, doing so would likely shake financial markets and harm the Fed’s independence. Given the complexities of the Federal Reserve Act and recent interpretations by the Supreme Court regarding executive power, any attempt to oust Powell could prompt significant market volatility. Consequently, it seems beneficial for Trump to allow Powell to fulfill his term, as the potential fallout from a dismissal greatly outweighs the perceived advantages.